We changed our minds and decided to provide a complimentary web-based APR calculator instead.

Click HERE to try it out.

Why did we do this? The main reason is that APRWin is very hard to use. APRWin requires the user to determine the “unit period” of the loan….which is complicated. You can get different calculations using identical payment dates and amounts. Yep, doesn’t make sense to us either.

Determining the “unit period” is the real problem. With APRWin, the onus is on the auditor to determine the unit period and not all “monthly” loans are “monthly” or all “bi-weekly” loans 14 days. This is where the waters start to get muddy….when the unit period does not match the payment frequency of the loan. You have to be able to interpret Appendix J of the Federal Truth in Lending Act to determine if your unit period is correct. I listed a link to Appendix J below. If you can do this and you’re ever in Chicago, I’d like to shake your hand.

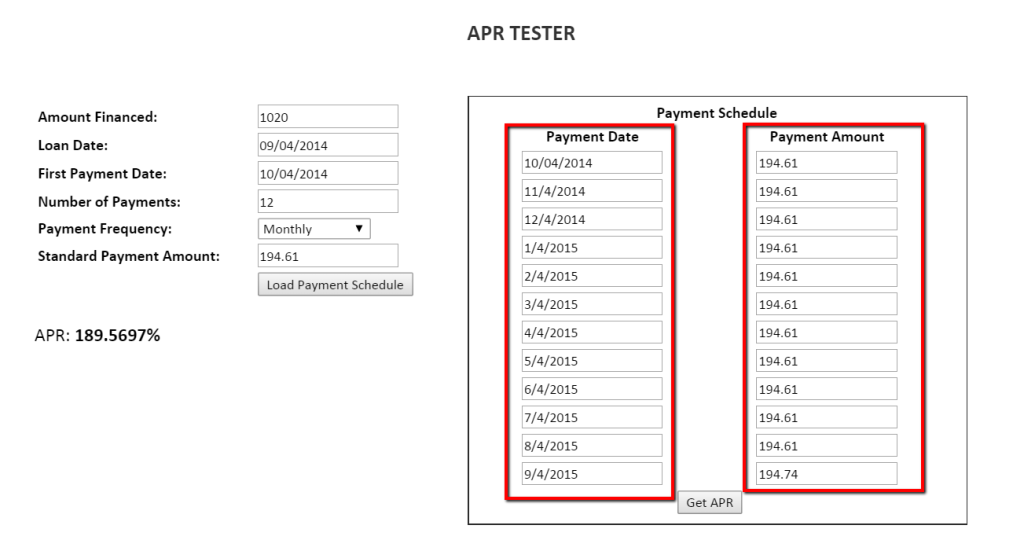

You can use our APR Tester HERE. We’ll provide an APR that is within the 1/8% of the federal tolerance. Just plug in the Amount Financed, payment dates and payment amounts.

If you like torture, you can read Appendix J of FTIL (Federal Truth in Lending).

TIPS:

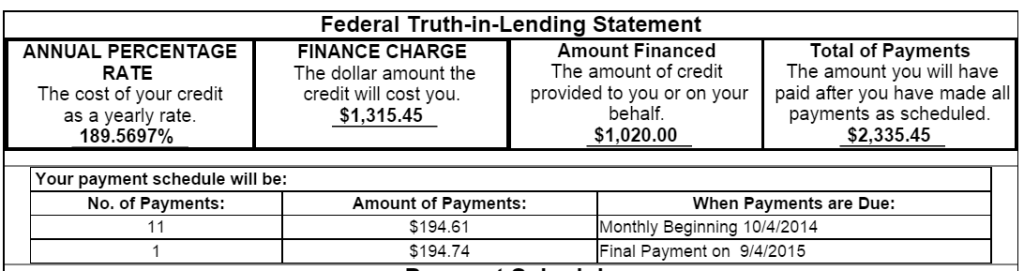

Using this example TILA example:

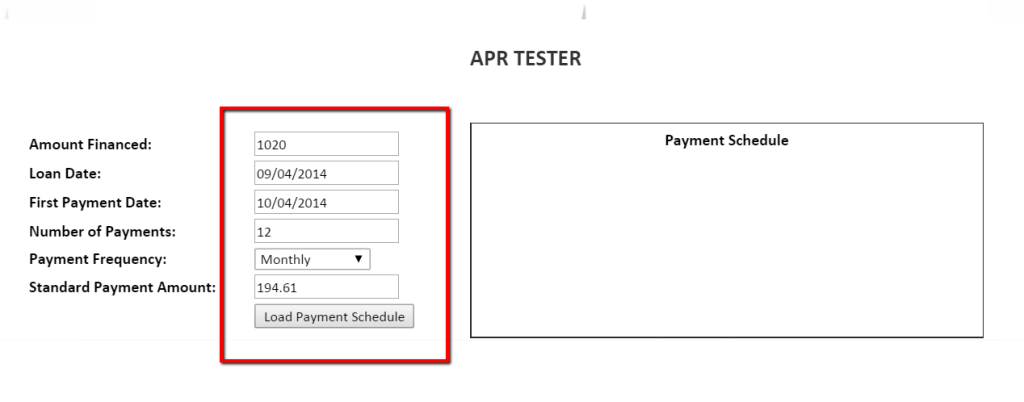

Step 1: Enter in the standard loan data. This will create payment dates and amount…that you can edit in the next step. Step 2: Modify any payment dates (date roll) or payment amounts. Typically, you’re always going to have to change the last payment to match your TILA. Click “Get APR”.

Step 2: Modify any payment dates (date roll) or payment amounts. Typically, you’re always going to have to change the last payment to match your TILA. Click “Get APR”.